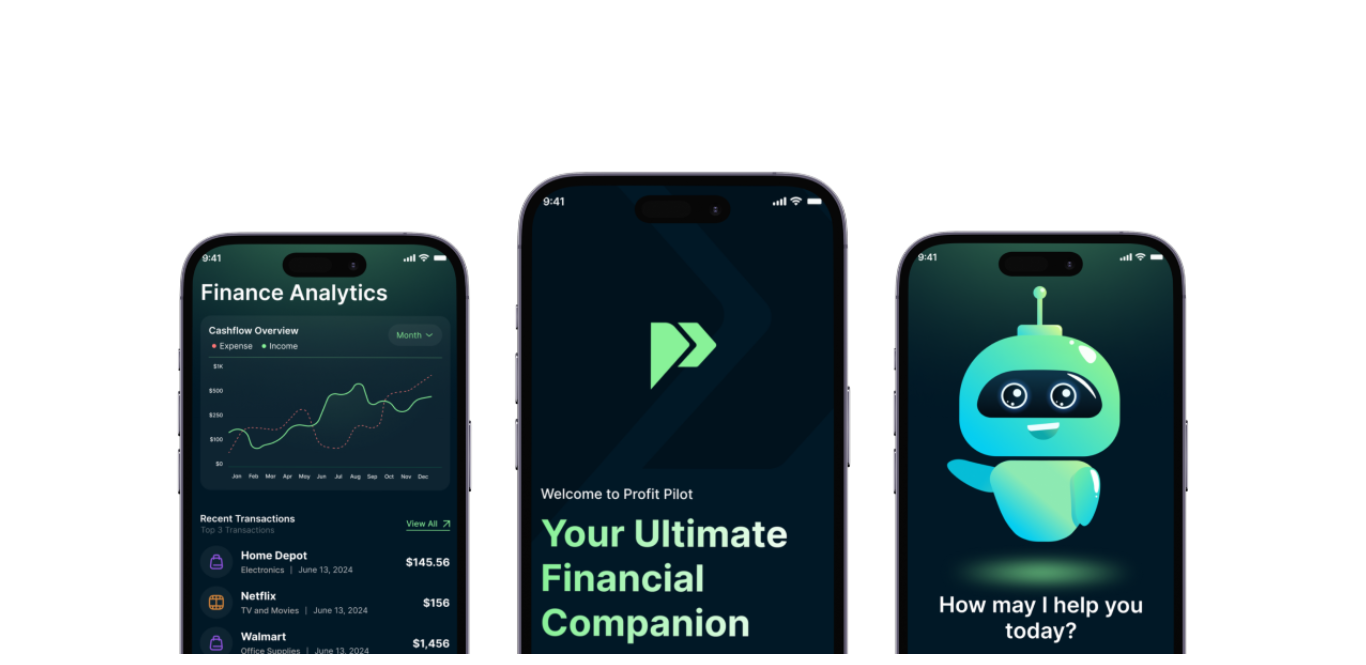

Finally, a Financial App Built for 1099 Workers and Solo Entrepreneurs

Track income. Categorize expenses. Save for taxes—without the stress of spreadsheets or confusing software.

Built with Trusted Technology You Can Rely On

Profit Pilot is powered by industry-leading platforms like Plaid, Google, Flutter, and Apple—ensuring your financial data is secure, reliable, and always up to date.

Handle Your Finances with Confidence

All in One App

Profit Pilot was built for freelancers, 1099 workers, and solo business owners. Easily track your income, log miles, taxes and save for retirement without spreadsheets or stress.

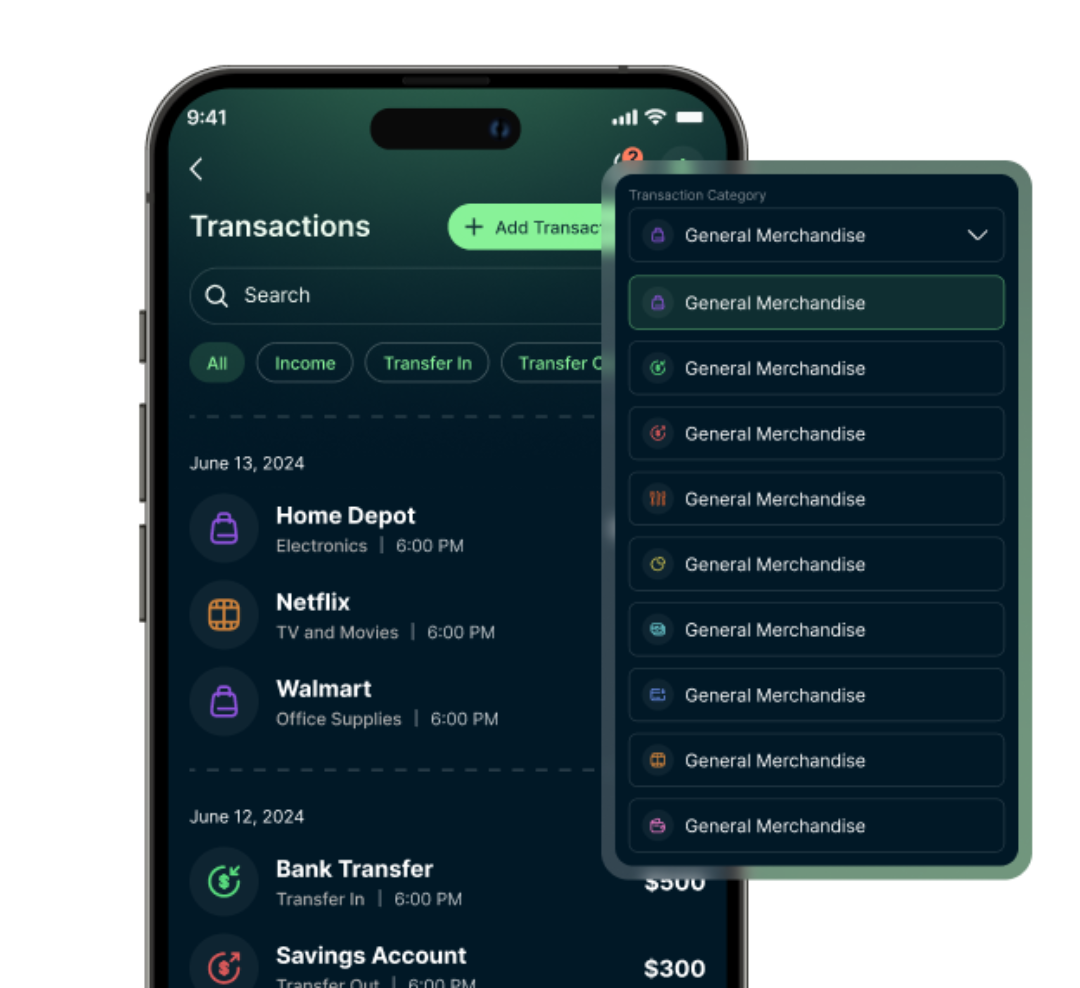

Smart Expense

Tracking

Every transaction is auto-categorized—no need to touch a spreadsheet.

Mileage Logging

Made Simple

Track your miles with a tap and instantly calculate deductions.

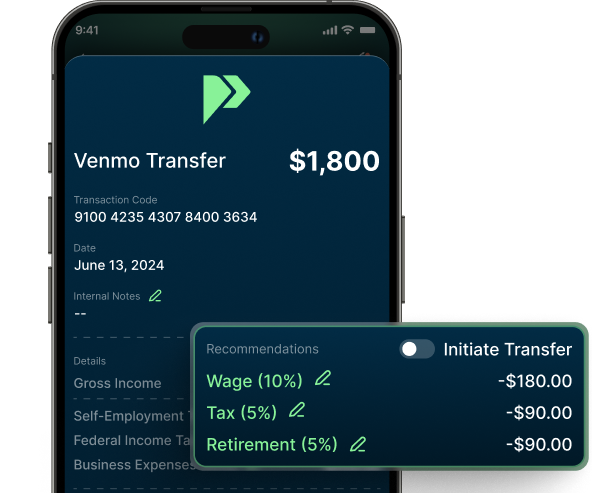

Tax Savings

Insights

Receive personalized suggestions for tax savings allocations.

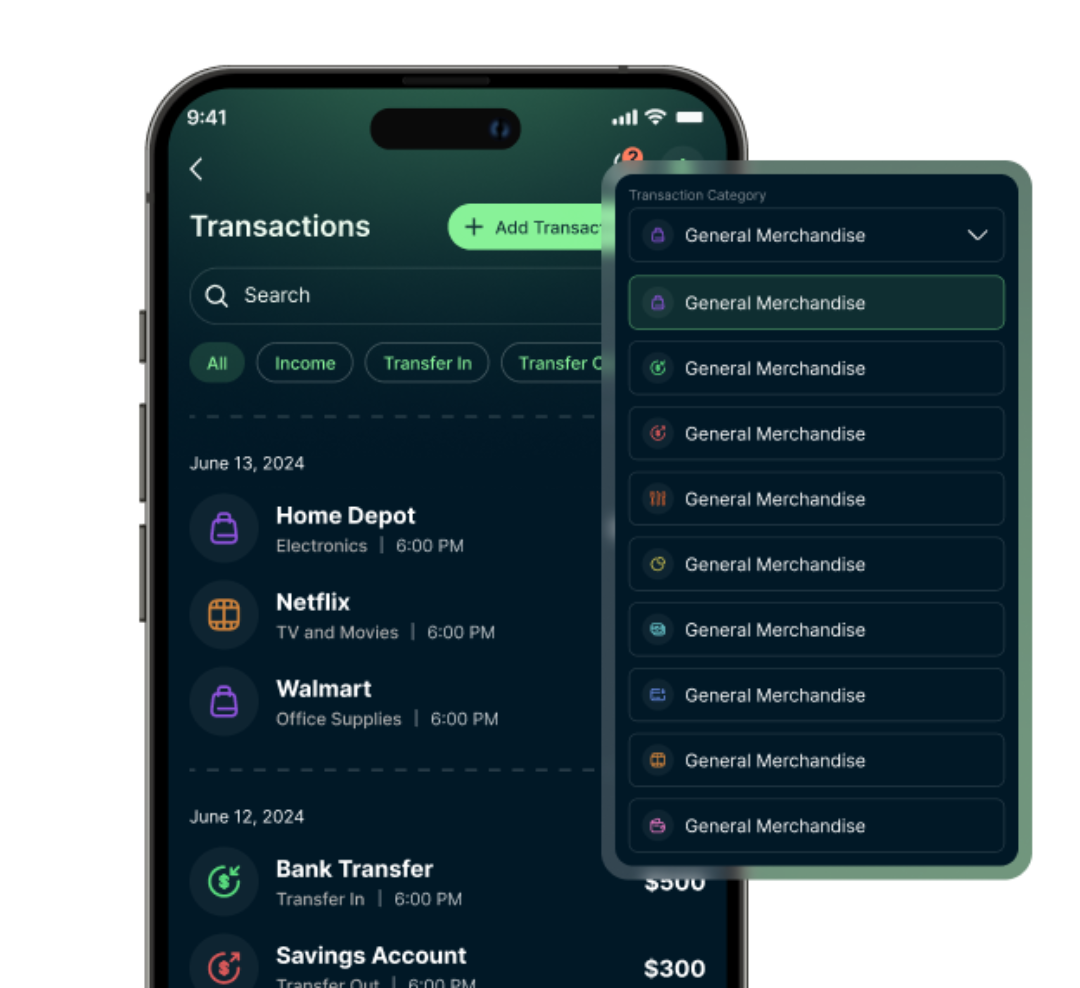

Track Every Dollar. Categorize Every Expense. Automatically.

Effortlessly track and categorize all your financial activities with the Profit Pilot App. Stay organized and in control.

Created to Simplify

Life for 1099 Workers

Whether you’re a lash artist, lawn care pro, rideshare driver, event planner, appliance repair tech, or social media manager, Profit Pilot helps you track your income, plan for taxes, and stay organized—without the overwhelm.

Start Smart

with Profit Pilot

Designed for everyday entrepreneurs like you—simple, powerful, and built for real life.

Built with Real Feedback

from Self-Starters

We're shaping Profit Pilot based on real struggles from everyday entrepreneurs. If you’ve ever felt lost come tax time, this is for you.

Mileage Tracking That Actually Makes Sense

Whether you’re a truck driver, real estate agent, or massage therapist, Profit Pilot was built to make life easier. Just log your miles and we’ll handle the math. No spreadsheets. No guesswork.

Want early access to tools built for self-employed workers like you?

Join the waitlist and be first in line.

Stop Guessing Your Taxes. Start Saving Smarter.

Profit Pilot breaks it down in a way that makes sense. No jargon. No complicated forms.

Just a clear view of what you’ve earned, what you might owe, and how to stay ready all year.

Whether you're a photographer, personal trainer, or mobile detailer, this app was made to keep things simple—so you’re not scrambling or stressed when tax season hits.

Effortless Money Management for Self-Employed Workers

Profit Pilot helps solo entrepreneurs stay on top of their finances—without the complexity. It’s built for real people like hairstylists, photographers, fitness coaches, real estate agents, tattoo artists, and mobile car detailers who just want to know where their money is going and how much to set aside for taxes.

Calculate and record your mileage expenses

Keep track of every trip and automatically see how much you can deduct.

Facilitate secure account transfers with ease

Profit Pilot helps you know how much to set aside and when—so there are no surprises at tax time.

Be the First to

Try Profit Pilot

We’re building Profit Pilot for real people who are tired of complicated tools like QuickBooks. Whether you’re a HVAC technician, delivery driver, tutor, content creator, mobile mechanic, or construction subcontractor, this app is for you.

Join the waitlist and get early access when we launch, no spam, no pressure.

Satisfied Customers

Profit Pilot has transformed my financial management process.

FAQs

Find answers to commonly asked questions about our pricing and plans.

Profit Pilot is your financial superhero. Seriously. This app is a game-changer for entrepreneurs and employees. It seamlessly integrates with your bank, tracks your transactions in real-time, and even intelligently sorts your expenses. We’re talking total financial freedom, designed specifically for the unique needs of independent workers. We’re all about simplifying the complexities of self-employment. Focus on your business, not your finances.

Profit Pilot blends cutting-edge tech with financial smarts for a user-friendly experience. Here’s the lowdown:

- Bank Account Integration: Plaid securely connects to your bank accounts for instant transaction tracking and automatic categorization. Real-time data at your fingertips!

- AI-Powered Virtual Assistant: Think of it as your own personal financial guru. Ask questions (“How much should I save for taxes?”), get smart answers, and get personalized insights.

- Expense Management and Tax Compliance: We automate expense categorization, income tracking, and even help you stay on top of taxes—both federal and state.

- User-Friendly Dashboard: Your financial life, simplified. See everything clearly. We’ve got detailed reports, expense breakdowns and mileage tracking.

Rock-Solid Security: Your data is safe with us, protected with robust security measures. No worries about breaches or unauthorized access.

Security is our top priority. We use top-notch security protocols to keep your financial data private and protected.

- Plaid’s Got Your Back: Plaid’s high-security standards add an extra layer of protection.

- Data Encryption: Your financial data is encrypted using the strongest methods available.

- Secure Authentication: Multi-factor authentication (MFA) adds extra security. It’s like a fortress for your financial information.

- Regular Security Audits: We’re constantly monitoring and improving our security measures.

You’re in Control: You always have control over your data and privacy settings.

Profit Pilot is perfect for entrepreneurs and employees. The biggest pain points for this group are often:

- Expense Tracking: Too many receipts, too little time.

- Tax Management: Taxes are complicated enough without the added stress of self-employment.

- Financial Reporting: Generating accurate reports is a time-suck.

- Lack of Tools: Most financial apps aren’t designed for the unique needs of the self-employed.

Profit Pilot simplifies all of this with real-time tracking, automated expense management, and personalized insights.

Profit Pilot’s AI assistant is like having your own personal finance expert.

- Personalized Insights: Get answers that are specifically relevant to your financial situation.

- Ask Away: Have questions? Get quick and helpful answers from the AI.

- Task Automation: Automate tasks like expense categorization.

- Real-Time Alerts: Stay up-to-date with important notifications.

Financial Planning: Use the AI to help plan for the future.